-

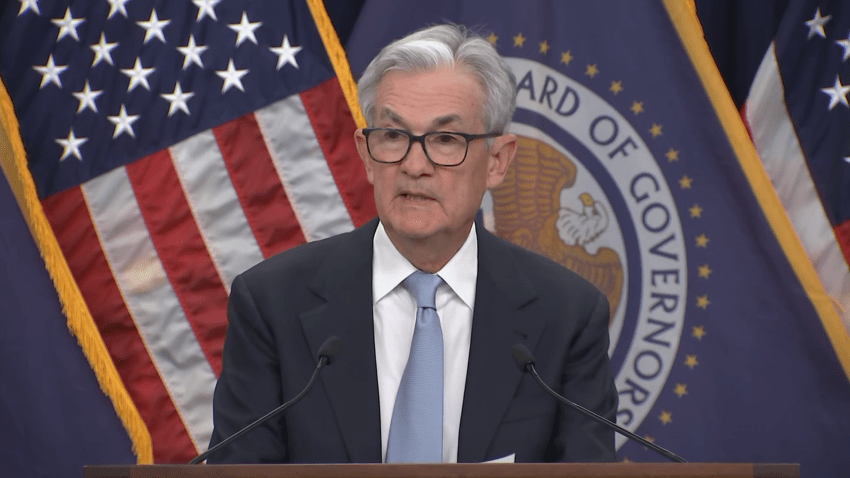

Powell Expects More Fed Rate Hikes Ahead as Inflation Fight ‘Has a Long Way to Go'

Noting that inflation has cooled but “remains well above” the Fed’s 2% target, Powell said the central bank still has more work to do.

-

Jerome Powell on Latest Interest Rate Hike: ‘Inflation Pressures Continue to Run High'

“The labor market remains extremely tight,” the chair of the Federal Reserve, Jerome Powell, said Wednesday. “Inflation remains well above our longer-run goal of 2%.”

-

Here's How the Fed's Rate Hike May Affect Your Wallet

The Fed’s seventh rate hike this year will make it even costlier for consumers and businesses to borrow for homes, autos and other purchases.