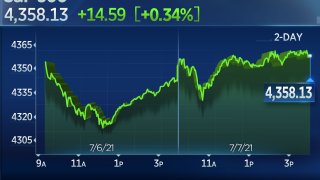

The S&P 500 rose to a fresh record on Wednesday as investors poured back into trusty mega-cap technology stocks.

The S&P 500 advanced 0.34% to an all-time high of 4,358.13 after the index ended a seven-day winning streak in the previous session. The Dow Jones Industrial Average rose 104.42 points to 34,681.79. The technology-heavy Nasdaq Composite closed flat at 14,665.06 despite hitting a fresh intraday record shortly after the open.

With rates falling and Wall Street fretting about a peak in economic growth, investors have rediscovered their old Big Tech favorites. Apple and Amazon are both up about 15% over the past month, far outpacing the S&P 500's 3.1% return. Apple rose 1.8% and Amazon gained nearly 0.6%.

We're making it easier for you to find stories that matter with our new newsletter — The 4Front. Sign up here and get news that is important for you to your inbox.

Defying many predictions, the 10-year Treasury yield fell as low as 1.296% on Wednesday.

"As has been the case for some time, the direction of bond yields and tech stock have been joined at the hip," Jim Paulsen, chief investment strategist at the Leuthold Group, told CNBC. "Traders will be watching as the S&P 500 tech index moves closer to its relative price high established last September. A break above that level would certainly reinforce a sustained leadership cycle for tech."

The Federal Reserve's minutes from its June 15-16 meeting, during which it held short-term interest rates near zero but also indicated that it might be adjusting policy otherwise in the months ahead, revealed the central bank discussed tapering but was in no rush to start the process.

Money Report

Energy stocks were in the red as oil prices fell. WTI crude touched a six-year high briefly on Tuesday before retreating. Crude was down again on Wednesday. Occidental Petroleum fell nearly 3.4% and APA Corp. and Pioneer Natural Resources both dipped about 2.3%.

Bank shares including Goldman Sachs and Bank of America continued their retreat on Wednesday as long-term bond yields fell further, hurting the industry's profitability prospects. Yields on the short-end of the so-called Treasury curve, including 1-year bills and 2-year notes, were flat to higher.

Investors may be worried the economy might be approaching its peak and that a correction could be on the way. In addition to complacency in the market, the combination of profit-margin pressures, inflation fears, Fed tapering and possible higher taxes could contribute to an eventual drawdown, market strategists say.

— CNBC's Patti Domm contributed reporting.