- More than two-thirds of federal student loan borrowers say it would be difficult for them to resume their monthly payments.

- That's the finding from a survey conducted for The Pew Charitable Trusts, which comes as the U.S. Department of Education's payment pause and interest waiver for borrowers is set to expire at the end of September.

More than two-thirds of federal student loan borrowers say they're not ready to resume their monthly payments.

That's the finding from a survey conducted for The Pew Charitable Trusts, which comes as the U.S. Department of Education's payment pause and interest waiver for borrowers is set to expire at the end of September.

Around 60% of borrowers who are taking advantage of the relief said they were using the extra cash for essential expenses, including rent and food. The average student loan bill is around $400 a month.

We're making it easier for you to find stories that matter with our new newsletter — The 4Front. Sign up here and get news that is important for you to your inbox.

"This shows that while the economy is recovering, not all households are, so the student loan pause continues to be a significant lifeline for borrowers," said Regan Fitzgerald, manager of The Pew Charitable Trusts' project on student borrower success.

More from Personal Finance:

Stock market volatility can be opportunity for investors

Where efforts to raise federal minimum wage stand

Covid scams cost Americans nearly $500 million

There are signs that the White House is considering an extension.

Money Report

U.S. Education Secretary Miguel Cardona told the Senate Appropriations Committee in June that he was involved in conversations over whether October was the best time to resume payments. In May, at an Education Writers Association conference, Cardona said extending the payment pause was on the table.

At the same time, a recent change in student loan servicing could work in borrowers' favor.

The Pennsylvania Higher Education Assistance Agency — which oversees loans of 8.5 million student borrowers — announced this month it would not renew its contract with the federal government when it ends in December. As a result, those borrowers will need to be matched with a new lender.

"It would be confusing for PHEAA borrowers to restart repayment on Sept. 30, only to change servicers on Dec. 14," said higher education expert Mark Kantrowitz. "It would be better to combine both changes so that they occur at the same time."

Democratic legislators and student borrower advocates are pushing for an extension.

Sen. Elizabeth Warren, D-Mass., and Senate Majority Leader Chuck Schumer, D-N.Y., sent a letter in June to President Joe Biden, urging him to keep the payment pause in effect until March 2022. That would mean most borrowers wouldn't have made a payment on their student loans in two years.

More than 120 organizations, including the American Civil Liberties Union, the National Consumer Law Center and the Consumer Federation of America, also recently wrote to the president, asking him to extend the payment pause until student debt has been forgiven.

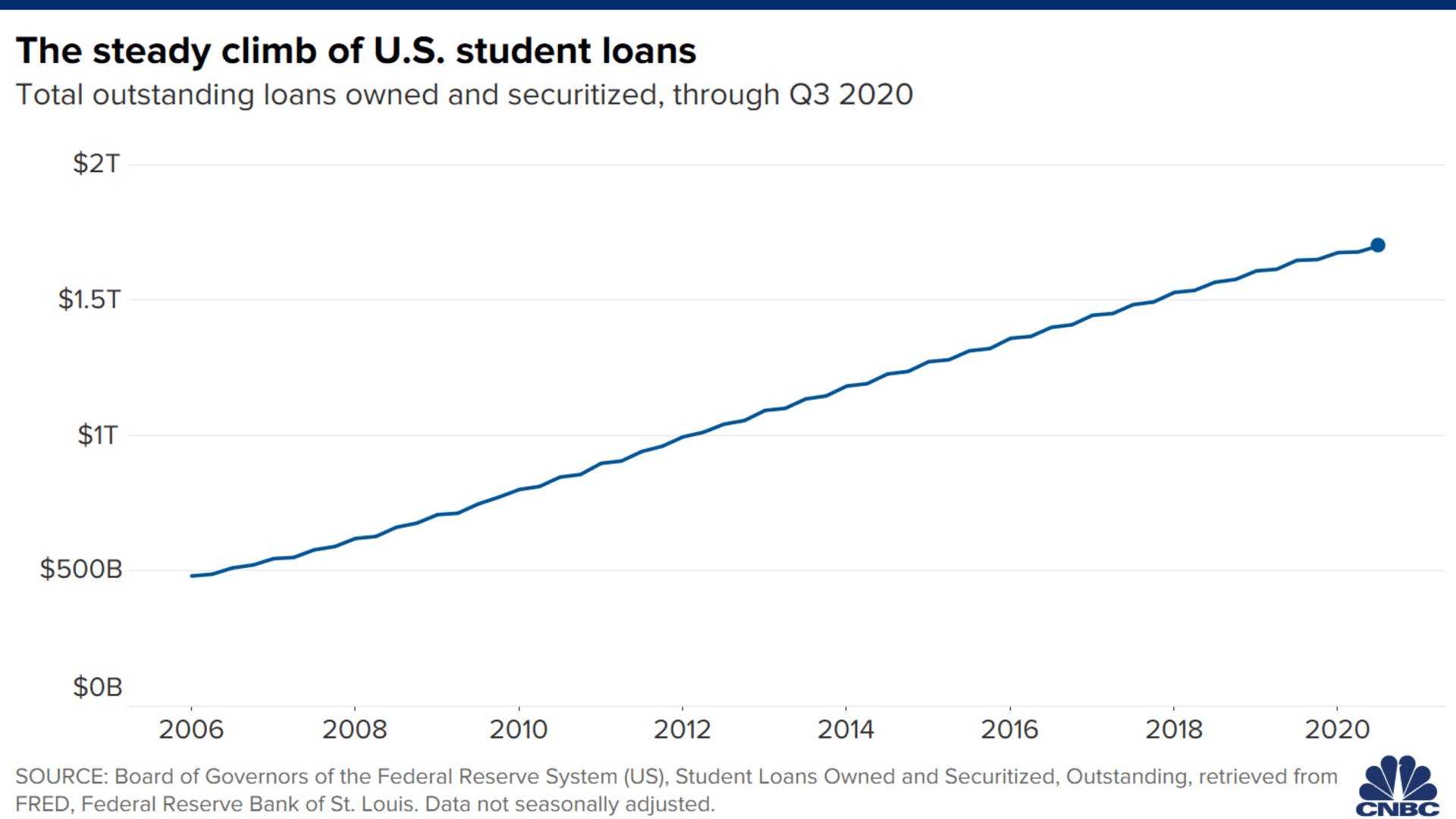

Borrowers were struggling before Covid, with more than 1 in 4 in delinquency or default. After more than a year of record-high unemployment levels, that pain has only worsened. The Congressional Budget Office recently predicted that the jobless rates for younger workers will be slower to improve than the overall rate.

"Best guess is that the payment pause and interest waiver will be extended if the unemployment rates for college graduates have not yet normalized as of Sept. 30, 2021," Kantrowitz said.

Still, Kantrowitz said borrowers may be underestimating how ready they are to resume payments after such a long break from them.

"What people say and what people do are often two entirely different things," he said.