Struggling online deals pioneer Groupon has fired its quirky founder and CEO, Andrew Mason, and named Ted Leonsis as a co-chief executive until a permanent replacement comes in.

In a refreshingly candid memo to staff, Mason admitted he "failed at this part of the journey" and said Groupon's employees "deserve the outside world to give you a second chance. I'm getting in the way of that. A fresh CEO earns you that chance."

Groupon Inc.'s stock jumped more than 4 percent in extended trading following Thursday's announcement, which had been anticipated for months. Executive Chairman Eric Lefkofsky and Vice Chairman Ted Leonsis were appointed to the Office of the Chief Executive while a replacement is found.

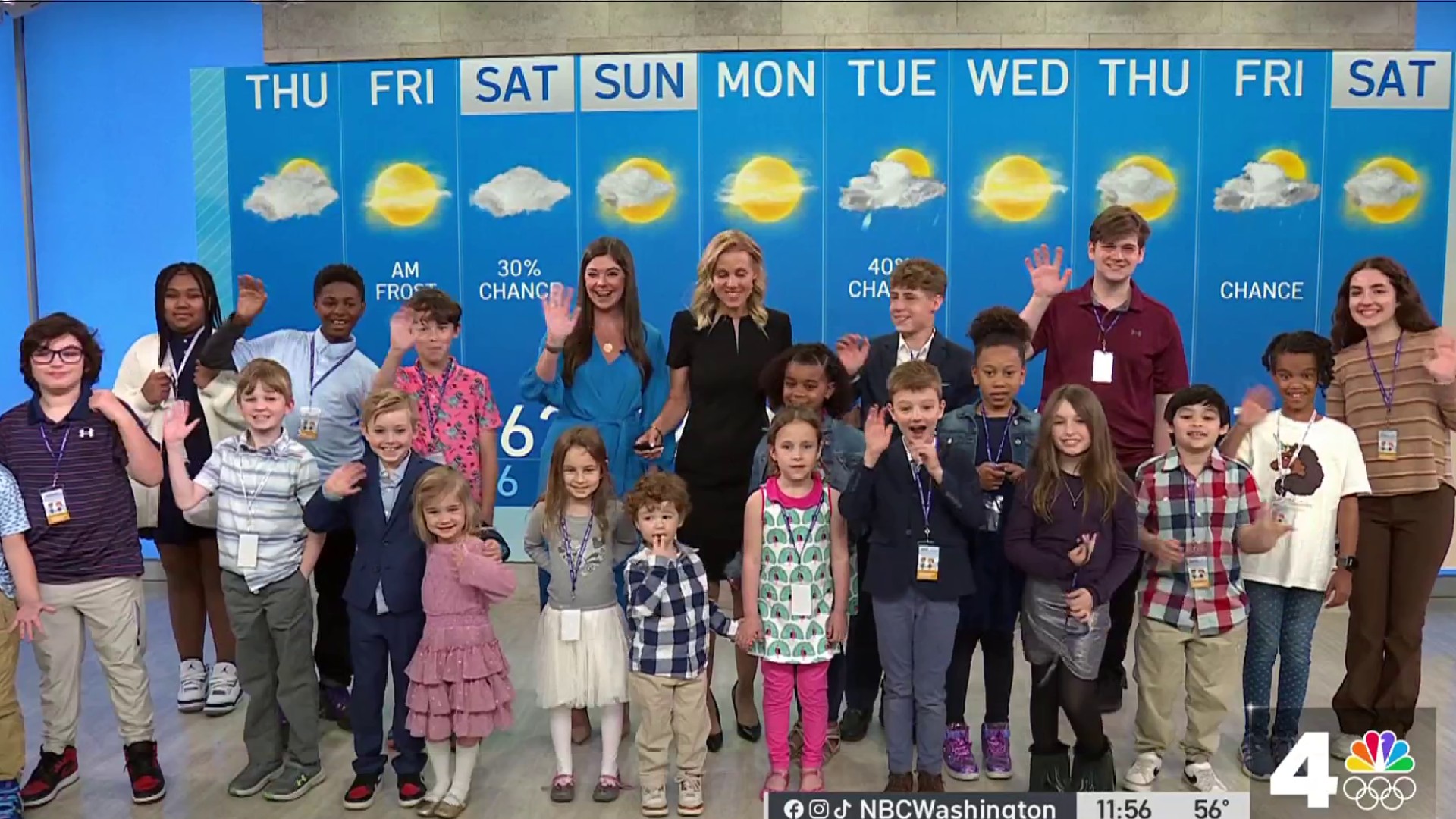

Leonsis sits on the board of directors at American Express and owns the Washington Wizards, the Washington Capitals and the Verizon Center.

Mason, known for an eccentric character that didn't fit the mold of a buttoned-down CEO, made no qualms about what had happened.

"I've decided that I'd like to spend more time with my family. Just kidding -- I was fired today," wrote Mason, 32. "If you're wondering why. you haven't been paying attention."

Mason, a Northwestern University graduate and former punk band keyboardist, founded Groupon in 2008, pioneering the daily deals business. The idea is that if enough people sign up for a discount -- for restaurant meals, manicures or weekend getaways -- offering the deals will be worthwhile for businesses, especially if customers bring friends or come back.

Local

Washington, D.C., Maryland and Virginia local news, events and information

Groupon makes money by taking a cut from those deals. By 2010, Groupon was available in 25 countries, and some people saw online deals as the next big thing in retailing.

But analysts have been questioning the long-term viability of such a business, not just at Groupon but also at the long list of copycats, which include LivingSocial, Google Offers and Amazon Local.

While the business is easy to set up, it is difficult to sustain and to stand out.

LivingSocial, Groupon's closest competitor, laid off 9 percent of its workforce late last year. To diversify its business, Groupon has expanded into product sales, payments services and other areas, but there have been worries that those efforts haven't been paying off.

Groupon, which is based in Chicago, also has faced scrutiny about its high marketing expenses and enormous employee base. Its staff has ballooned to more than 11,000, more than that of other Internet darlings such as Twitter, Facebook or Zynga Inc., the other fallen star of the latest swath of Internet IPOs.

Thursday's announcement came one day after more disappointing news on revenue. The company said revenue in the current quarter would be in the range of $560 million to $610 million, below analyst expectations of $647 million.

Mason's ouster has been "fairly widely expected" given the company's performance, said Gartner analyst Michael Gartenberg. He was more surprised by the fact that "it took them this long."

"The question is whether this as a business model can last," Gartenberg said. "It's easy to replicate and under a lot of pressure. The question is where the company goes from here.... Clearly something wasn't working, isn't working."

Groupon said Mason was not available for interviews.

Benchmark Capital analyst Daniel Kurnos said that with Mason's ouster, the board made the decision to try to "get the ship moving in the right direction."

"There was always a sense that Groupon had a lot of good ideas but no real focus," he said.

In a statement, Leonsis said that the company "will continue to invest in growth, and we are confident that with our deep management team and market-leading position, the company is well positioned for the future."

After the announcement of Mason's ouster, the stock gained 19 cents to $4.72 in after-hours trading. The modest 4.2 percent gain, compared with the 24 percent drop earlier in the day, is a sign that investors will need more than the CEO's firing to start believing in Groupon again.