- West Coast ports have seen several supply chain snags arise amid ongoing labor issues.

- Union Pacific has issued a temporary pause of all inland rail ramps to the ports of Los Angeles and Long Beach because of port congestion.

- The Port of Los Angeles is the nation's busiest port, processing $440 billion in cargo value per year, and is a significant shipping point for the U.S. agriculture industry.

- Negotiations between the ILWU longshoremen union and the Pacific Maritime Association continue to go on as scheduled this week.

Union Pacific has temporarily shut down all of its inland ramps at the Port of Los Angeles and the Port of Long Beach, a proactive move that reflects the supply chain issues that have arisen due to ongoing West Coast port labor issues.

By pausing rail shipments, shippers can find other ports to send goods rather than have them sit for extended periods of time in containers before reaching their intended destinations. That is critical for food and agriculture shipments, where products can spoil — the U.S. agriculture industry uses the West Coast predominantly for its goods.

The railroad had previously stopped accepting exports or empty containers at its Denver rail terminal destined for the Port of Los Angeles. The proactive measures aim to avoid the rail and shipping congestion issues that plagued ports for much of 2022, with the goal of having the pause helping to alleviate the congestion, sources told CNBC.

We're making it easier for you to find stories that matter with our new newsletter — The 4Front. Sign up here and get news that is important for you to your inbox.

The Port of Los Angeles is the nation's busiest port, processing $440 billion in cargo value per year. That market share has declined with more trade moving to the East Coast over the past year, at least partially due to labor issues on the West Coast that had supply chain managers worried about reliability of service.

These latest issues have arisen as the specialized workers who work on the rail shipments are not reporting at the union halls, according to CNBC sources.

Ocean carrier CMA sent an email today to clients that CNBC obtained notifying them of Union Pacific's decision.

Money Report

"Union Pacific issued a temporary pause for shipments from our inland terminals into three terminals at the Ports of Los Angeles and Long Beach where we saw some freight starting to accumulate. Our goal with this short-term pause is to ensure the rail line to and from the ports stays fluid," a Union Pacific spokesperson told CNBC in a statement.

Berkshire Hathaway subsidiary BNSF and Union Pacific are the railroads servicing the West Coast ports. BNSF has not responded to a request for comment.

"This is the ripple effect we are concerned about," said Paul Brashier, vice president of drayage and intermodal at ITS Logistics. "U.S. exports of protein and other products will start to back up in the inland ports. This will deteriorate rail productivity as a result of the growing container congestion."

Negotiations between the ILWU longshoremen union and the Pacific Maritime Association (PMA) continue to go on as scheduled this week, CNBC has learned. The subject of wages is still being hammered out. The talks are under the cloud of slow port productivity. The ILWU and PMA are not commenting, citing a media blackout.

The West Coast ports opened on Monday after multiple closures that began at the Port of Oakland last Friday when some union workers refused to report for assignments, However, issues remained at select terminals within ports from Los Angeles to Seattle, with labor slowdowns and shift closures.

Truckers tell CNBC they are still experiencing a "snail's pace of productivity" at the terminals. Data from various CNBC Supply Chain Heat Map data providers also show the delays.

ITS Logistics told CNBC its truckers were turned away by the terminal operator Fenix Marine Services, which is owned by ocean carrier CMA-CGM, at the Port of Los Angeles during the first shift Monday. They were picking containers from a variety of ocean carriers. Containers processed through the terminal include those owned by Maersk, OOCL, COSCO Shipping, Sealand (a Maersk company), and Evergreen.

Forty-five large commercial ships are currently on their way to Los Angeles, expecting to arrive within the next 2 weeks, according to tracking data from MarineTraffic, with 18 of those vessels scheduled to arrive within the next 5 days. Adil Ashiq, head of North America for MarineTraffic, told CNBC that a resolution to decrease port productivity needs to get resolved, and is critical to avoid an increase of supply chain issues that will impact both consumers and businesses.

"Reduced labor means reduced capacity to work vessels and send them back to sea," said Ashiq. "With the current situation unfolding, the port of Los Angeles will experience a pandemic-like crisis where vessels will fill up the anchorage, waiting to head to the terminal to load/offload cargo, causing once again the much-hated congestion at one of the largest ports in the United States."

Logistics companies with truckers on the ground tell CNBC in some ports they are slowdowns.

"We still see significant congestion at most terminals in LA today," said Brashier. "Drivers are experiencing long wait times to enter the terminals and to be serviced in the terminals.

"When our West Coast ports are undependable, agriculture exporters become undependable suppliers because our means from exports from the heartland to the West Coast have to suspend service," said Peter Friedmann, Executive Director, Agriculture Transportation Coalition (AGTC).

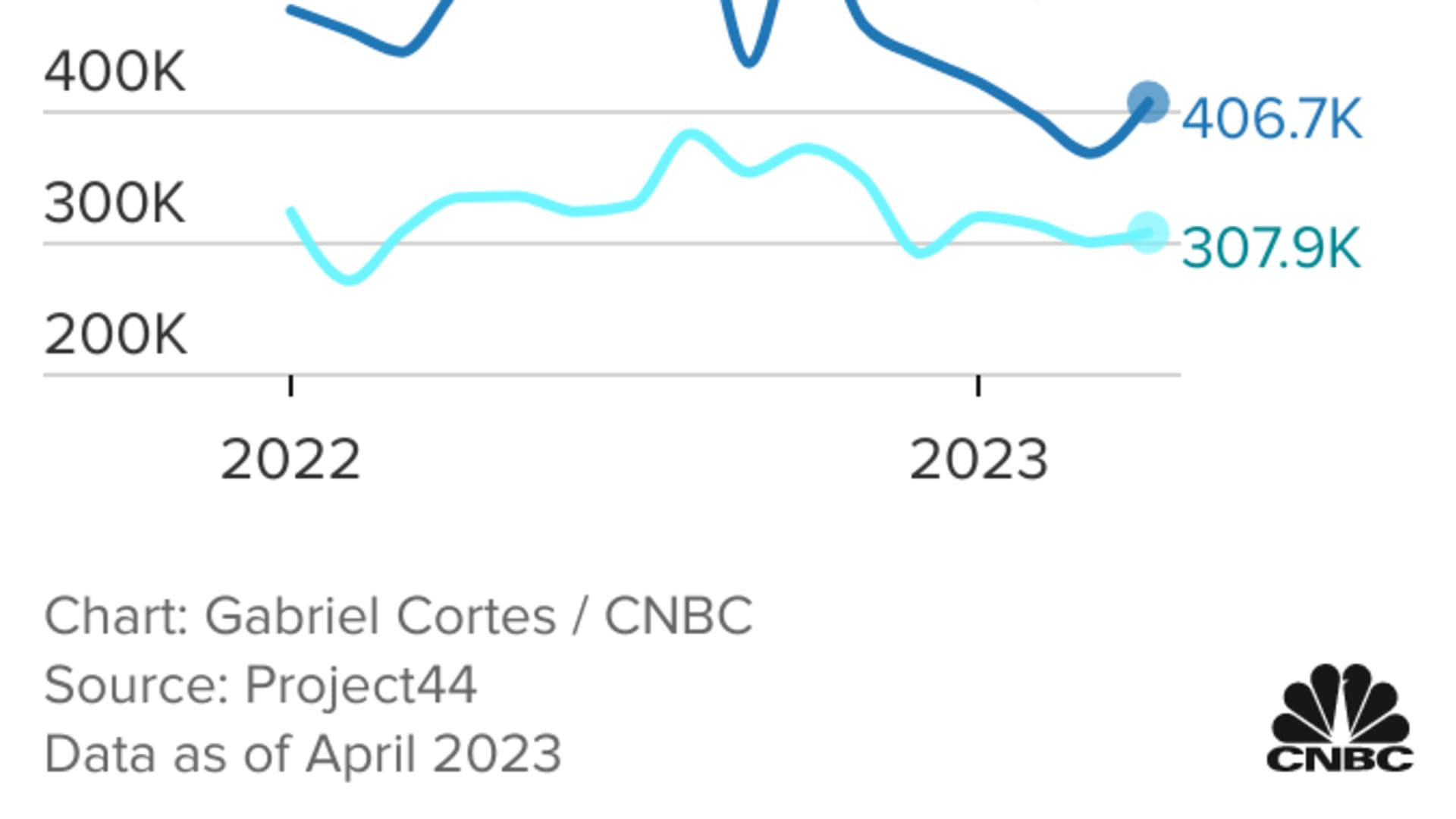

Overall, the West Coast ports have lost trade to the East Coast and Gulf Coast ports. CNBC has been tracking the container volumes of the ports of Los Angeles, Long Beach, Houston, New York, and Savannah.

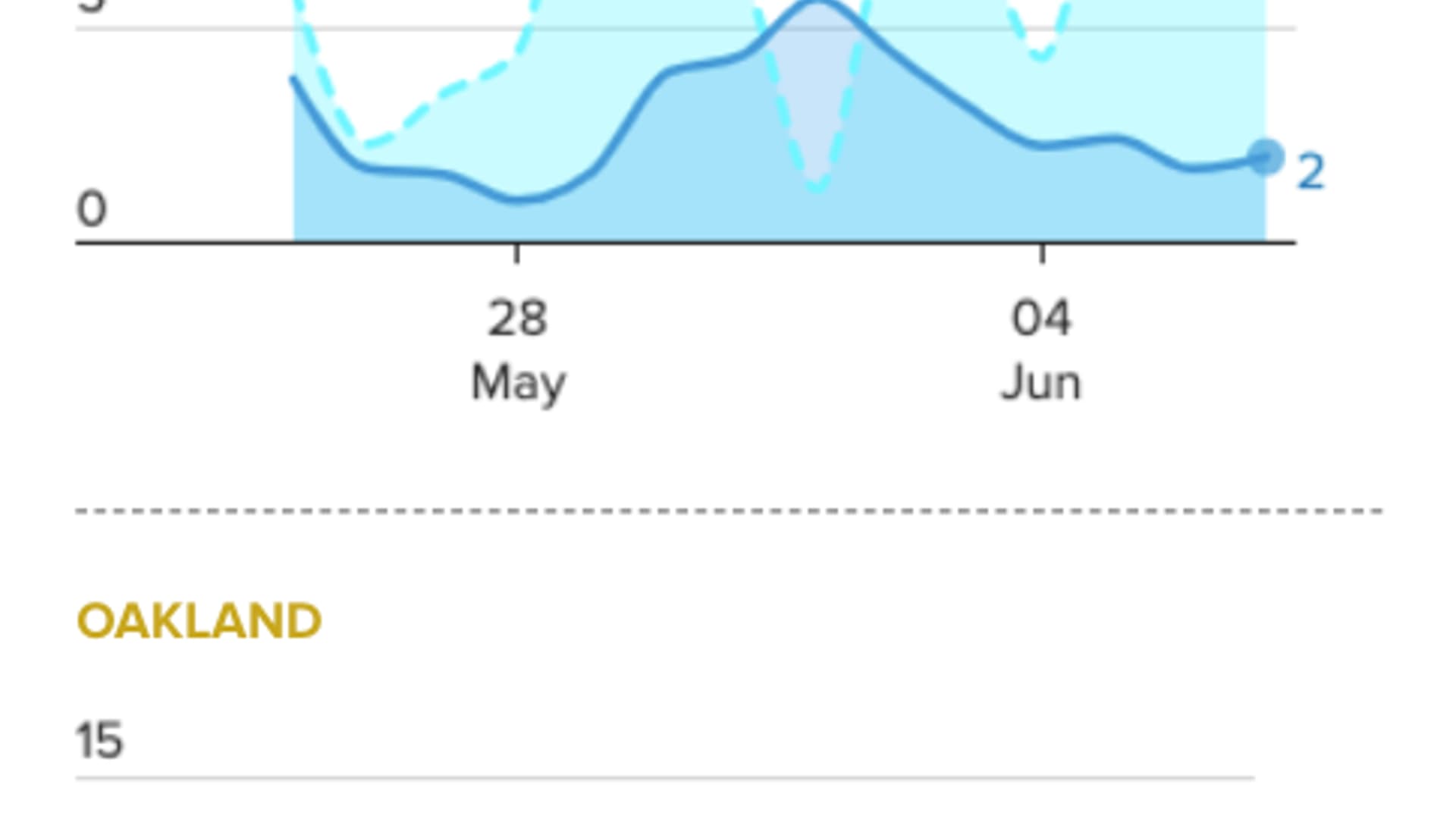

The container wait times out of the ports of Los Angeles, Long Beach, and Oakland continue to tick up. This is another physical indicator of slow-moving trade.

"The mounting backlog of shipments at the ports is anticipated to cause longer rail dwell times and create turmoil within the trucking industry as drivers navigate between clearing aged shipments and prioritizing high-priority ones," said Jenna Slagle, senior data analyst, marketing for Project44. "Furthermore, as terminals reopen following the labor disruptions, there is a potential for equipment shortages, specifically chassis, and constraints on yard capacity as they work towards clearing the backlog."

Congestion continues to impact the supply chain

Showing an example of the congestion impacting the supply chain, Ashiq highlighted containership MSC JEONGMIN, which was discharged in Oakland on May 31. Based on the wait time for containers to leave the port, products in these containers are still at the port.

The majority of items listed in the 320 containers brought in was all the trade originated from Canada, which include things like fresh apples and lentils, as well as frozen fish, poultry, and meat, according to customs data analyzed by ImportGenius.

This vessel has been unloading products at the ports of Los Angeles, Seattle, and Oakland. Products have included tires for Tesla cars, IKEA furniture, and Trader Joe's Petite peas from Portugal. It has also included hundreds of containers filled with wine from Europe, as well as porcelain tile and granite slabs.

"The situation for Port of Oakland is not looking good," said Ashiq. "The port is a first-come, first-serve, meaning that vessels are put in a queue for priority depending on their arrival time. What we're seeing is an anchorage that hasn't been this busy since at least March of this year, with nearly double the vessels waiting at anchorage compared to that time. "

According to MarineTraffic data as of press time, six vessels are waiting offshore and seven vessels are currently at anchorage. Reports of port fluidity amongst the truck drivers is welcome news to the logistic companies called 3PLs which manage the shipments for companies.

"In Oakland, conditions have improved greatly since last week's closures, which is good since we have a backlog of import containers to pull and exports to ingate for our clients," said Brashire.

Robert Bernardo, director of communications for the Port of Oakland, told CNBC that its marine terminals are back to full operation, and that the port is "making great progress with the backlog from the weekend shutdown."