Check out the companies making headlines in midday trading.

Poshmark — The online marketplace's shares tumbled nearly 29% Wednesday after reporting quarterly results late Tuesday. Poshmark reported a loss of 9 cents per share, versus analyst estimates of 7 cents per share. Revenue also came in weaker than expected at $79.7 million, versus $82.7 million expected by Wall Street.

DoorDash — The food delivery company's shares soared more than 11% on Wednesday after the company announced it would acquire Wolt for $8.1 billion. The company also reported a wider than expected third-quarter loss per share but beat on revenue estimates.

FuboTV — Shares of the streaming platform sank 23% after the company reported a loss late Tuesday of 59 cents per share and revenue of $156.7 million for the third quarter. It also increased its guidance for the fourth quarter.

We're making it easier for you to find stories that matter with our new newsletter — The 4Front. Sign up here and get news that is important for you to your inbox.

Unity Software — The video game software development company saw 2.8% after beating third-quarter earnings and revenue expectations and raising its full-year guidance. Unity also announced it plans to buy "Lord of the Rings" visual effects maker Weta Digital for more than $1.6 billion in cash and stock.

Wendy's — Shares of Wendy's dropped 7% after the fast-food chain posted quarterly financial results. It recorded a slight earnings beat of 19 cents per share on revenue of $470.3 million, versus the expected 18 cents per share on revenue of $470.2 million, according to Refinitiv. However, it reported global same-restaurant sales growth of 3.3% in the quarter, compared to consensus expectations of 4.9%.

Palantir — Palantir shares dropped more than 7% after RBC downgraded the stock to underperform from sector perform and cut its price target on it to $19 per share from $25 per share. RBC in its call cited Palantir's slowing revenue growth.

Money Report

Coinbase — Shares of Coinbase fell 8% after the company reported quarterly revenue Tuesday of $1.31 billion, which missed analysts' expectations. Monthly active transaction users were lower from the previous quarter, at 7.4 million, but up from the prior year. Transaction-based revenue was also lower from the previous quarter.

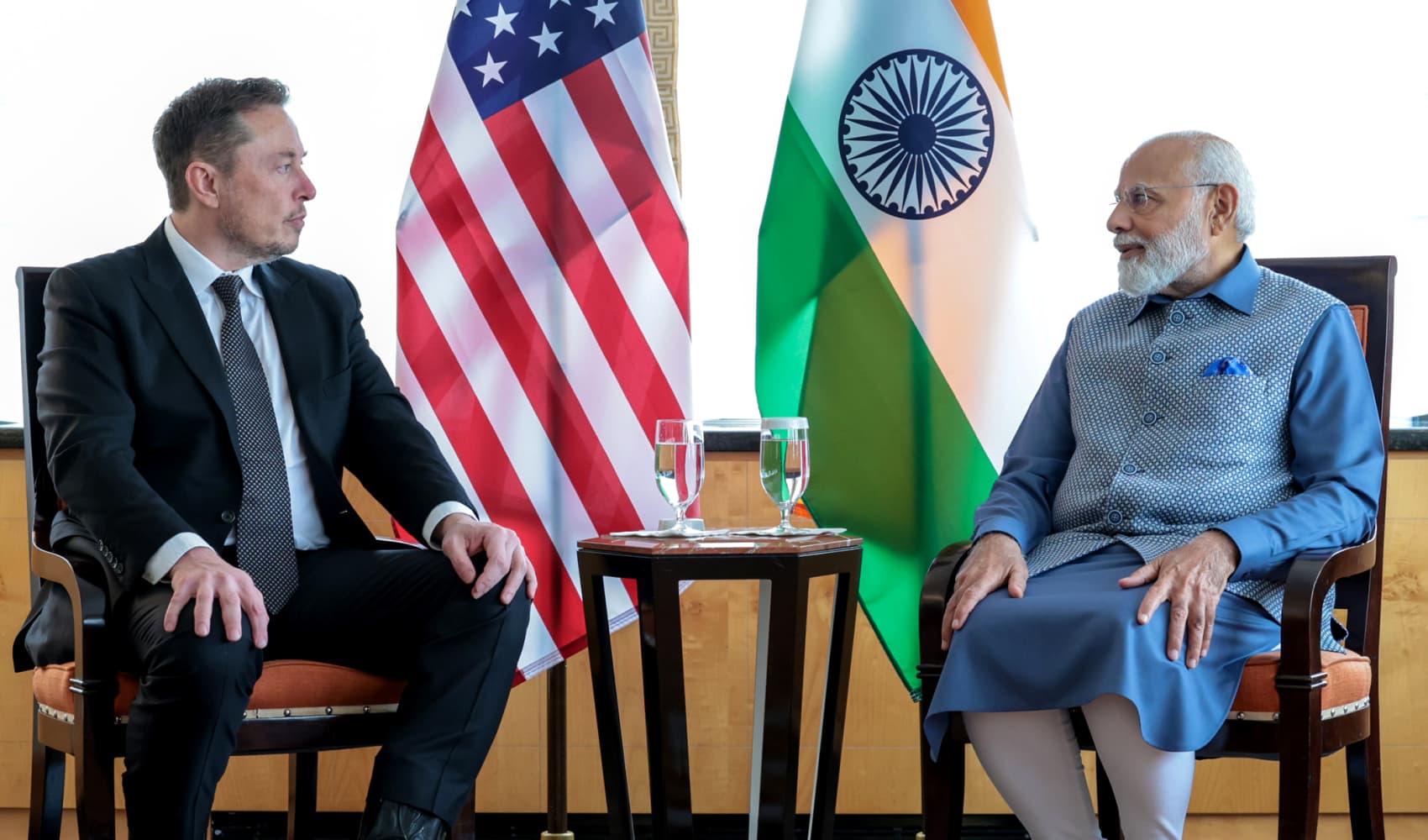

Tesla — Shares of Tesla rebounded more than 4%, snapping a down spell. The stock is about 13% lower this week after CEO Elon Musk in a Twitter poll over the weekend proposed selling 10% of his Tesla shares.

Mastercard — Mastercard shares rose 3.8% after the payments technology company disclosed new performance objectives for 2022-2024 at its Investor Day Wednesday showing faster earnings and revenue growth. It also announced the expansion of its buy-now-pay-later program.

Energy stocks — Energy stocks were among the top decliners in the S&P 500 as the American Petroleum Institute reported U.S. crude inventories rose by 1 million barrels in the most recent week, Reuters reported. Coterra Energy, Occidental Petroleum, Hess, Diamondback Energy and Halliburton each fell about 5%.

— CNBC's Hannah Miao and Maggie Fitzgerald contributed reporting