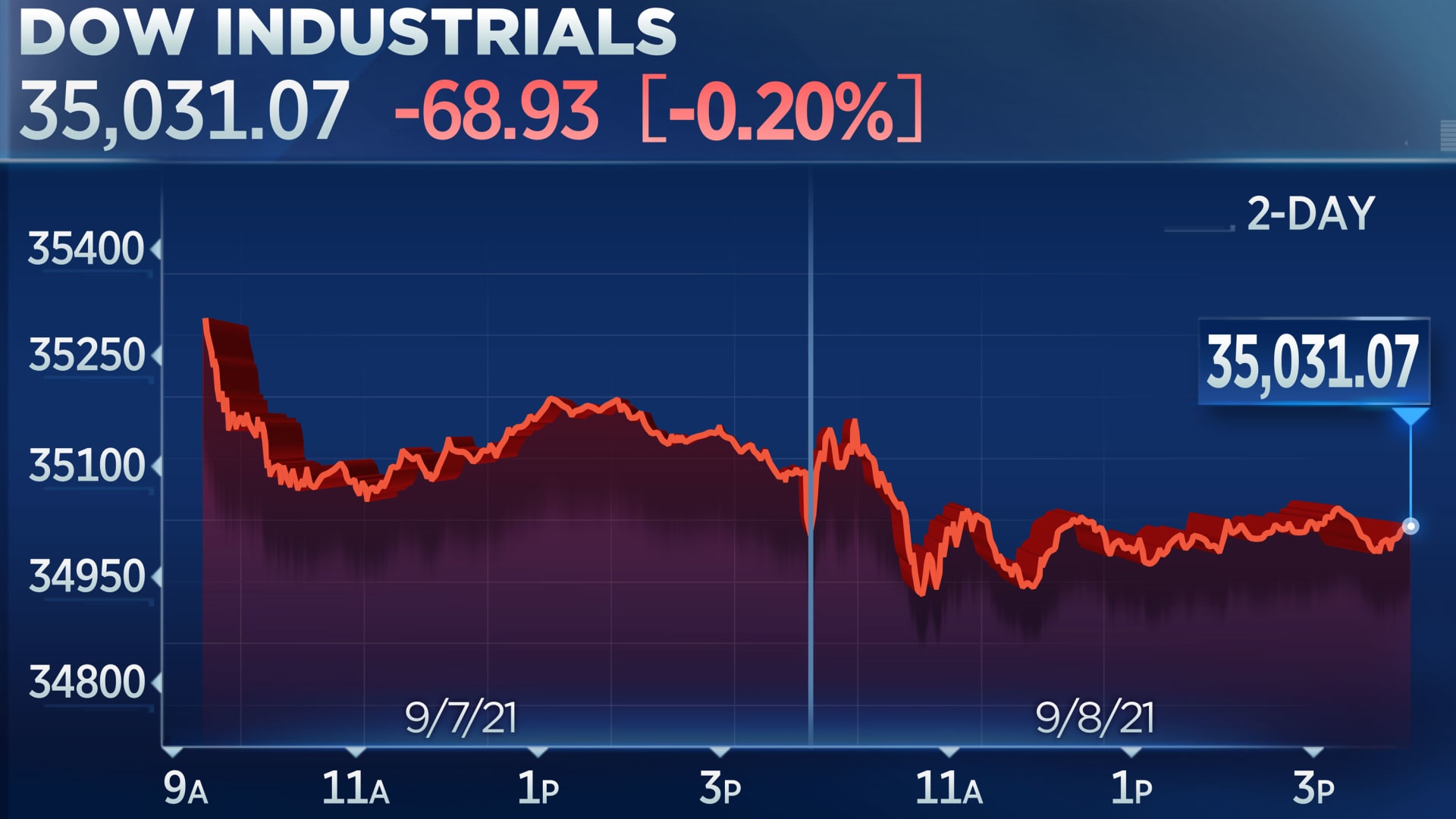

The Dow Jones Industrial Average and S&P 500 fell for a third straight day on Wednesday as investors reassess the economic growth outlook following a smooth ride in the market so far this year.

The Dow fell 68.93 points to 35,031.07 and the S&P 500 dipped 0.1% to 4,514.07. The technology-heavy Nasdaq Composite fell nearly 0.6% to 15,286.64, dropping for the first session in five.

The 30-stock average closed in the red for its third trading day in a row. On Tuesday, the Dow fell more than 260 points, adding to Friday's losses after a disappointing August jobs report. September's outlook also remains clouded by the coronavirus delta variant.

We're making it easier for you to find stories that matter with our new newsletter — The 4Front. Sign up here and get news that is important for you to your inbox.

Shares of Coinbase fell 3.2% after the cryptocurrency exchange revealed it received a notice of possible enforcement action from the Securities and Exchange Commission. Coupa Software fell 4.2% despite its better-than-expected quarterly financial results.

Many investors are bracing for volatility in September, one of the seasonally weakest months of the year. Price swings could make a comeback, especially with the S&P 500 up more than 20% this year without a single 5% pullback.

Money Report

"We see a bumpy September-October as the final stages of a mid-cycle transition play out," Morgan Stanley chief cross-asset strategist Andrew Sheets said in a note. "The next two months carry an outsized risk to growth, policy and the legislative agenda."

The S&P 500 is down about 0.2% this month. The Dow has slipped 0.9% in that time frame, and the Nasdaq is up nearly 0.2% in September.

One of the catalysts for a sell-off could be the Federal Reserve and the potential for it to pull back an unprecedented monetary stimulus to support the economy throughout the pandemic. Fed Chairman Jerome Powell has indicated that the central bank is likely to begin withdrawing some of its easy-money policies before year-end, though he still sees interest rate hikes in the distance.

"The summer rally to a new S&P high, with potential headwinds like rising rates on the horizon, has left investors debating whether U.S. equities can make meaningful new gains the rest of this year and into next year. Equities are likely to have a pullback at some point, likely driven by another reset in real yields higher, but other tailwinds should drive the S&P 500 to a new high by year end," UBS told clients on Wednesday as it raised its S&P 500 price target for the end of the year to 4,650 and for 2022 to 4,850.

On Wednesday, the Labor Department released the Job Openings and Labor Turnover Survey, which showed job openings rose to a record 10.9 million in July. Job openings outnumbered the unemployed by more than 2 million in July as companies struggled to fill a record number of vacancies.

In the Federal Reserve's periodic "Beige Book," the central bank said U.S. businesses are experiencing rising inflation that is being intensified by a shortage of goods and likely will be passed onto consumers in many areas.

The Fed also reported that growth overall had "downshifted slightly to a moderate pace" amid rising public health concerns during the July through August period that the report covers.

"The deceleration in economic activity was largely attributable to a pullback in dining out, travel, and tourism in most districts, reflecting safety concerns due to the rise of the delta variant, and, in a few cases, international travel restrictions," the report said.

The S&P 500 fell 0.3% on Tuesday in relatively thin trading following the Labor Day weekend. The blue-chip Dow dropped 260 points, weighed down by 3M and Honeywell, while the tech-heavy Nasdaq Composite rose less than 0.1% to eke out a record close.