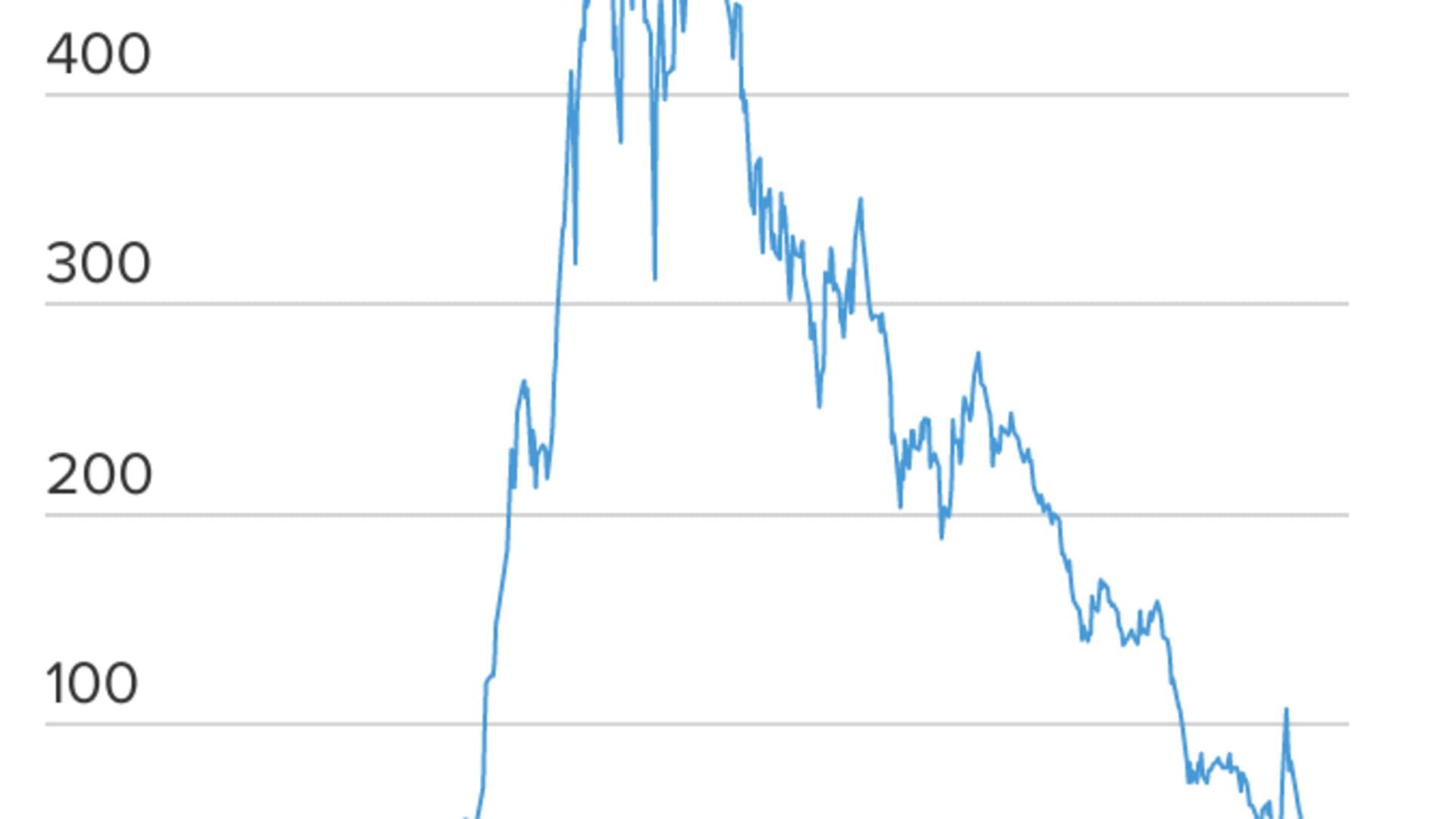

- Shares of Top Glove have erased much of the price increases gained during the Covid-19 pandemic as analysts turn more pessimistic about the company's outlook.

- Latest data on Refinitiv showed that 11 out of 23 analysts rated Top Glove "sell" or "strong sell" — an increase from six such ratings a month ago.

- Weak outlook for glove stocks, including Top Glove, is a reason why JPMorgan has an "underweight" recommendation for Malaysia for 2022.

Shares of Top Glove, the world's largest medical glove maker, have erased much of their gains notched during the Covid-19 pandemic as analysts turn more pessimistic on the company's outlook.

Top Glove's shares on the Malaysian stock exchange have tumbled by more than 60% this year to close at 2.20 Malaysian ringgit (around $0.52) on Monday.

That's 77% off the stock's record-high closing price reached on Oct. 19 last year, and around 0.70 ringgit higher than its last traded price in 2019 — before Covid spread globally.

We're making it easier for you to find stories that matter with our new newsletter — The 4Front. Sign up here and get news that is important for you to your inbox.

Several analysts have downgraded the stock. Latest data on Refinitiv showed that 11 out of 23 analysts rated Top Glove as a "sell" or "strong sell" — an increase from six such ratings a month ago.

One analyst that downgraded Top Glove from "hold" to "sell" is Ng Chi Hoong, an analyst from Malaysia-based Affin Hwang Investment Bank. Ng said in a report last week that the company's latest quarterly results were "relatively weak," while its upcoming listing in Hong Kong would weigh down the share price.

Top Glove earlier this month reported net profit of 185.7 million Malaysian ringgit for the quarter ended November — a 92% fall from the same period a year ago. The company said sales volume fell due to increased competition and supply, while average selling prices have come down from last year's peak levels.

Money Report

A few days before the earnings release, Top Glove said it received shareholders' approval for a dual primary listing in Hong Kong, which it expects to complete early next year. The company currently has a primary listing in Malaysia and a secondary listing in Singapore.

Analysts have warned that the Hong Kong listing would dilute Top Glove's earnings per share. Such concerns contributed to the fall in the company's share price this year.

Least preferred Malaysia stocks

Share prices of other Malaysian glove makers have also suffered.

Hartalega shares have fallen by around 56% this year as of Monday's close. Supermax and Kossan Rubber Industries have plunged by roughly 73% and 59%, respectively, during the same period.

Top Glove and Hartalega were among JPMorgan's least preferred stocks in Malaysia.

"Recent channel checks suggest pricing power shifting back to the buyers," JPMorgan said in a report earlier this month, adding that "demand had waned from peak pandemic levels while supply from China and Thailand continues to flood the market."

The weak outlook for glove stocks is a reason why the Wall Street giant has an "underweight" recommendation for Malaysia for 2022.

An underweight position typically reflects an investor's view that the market or stock will underperform.