- "The charts, as interpreted by Bob Lang, suggest that the semiconductor capital equipment names could give you a lot more upside," CNBC's Jim Cramer said.

- "This is one of those bull markets that works, regardless of how long it takes for us to roll out a Covid vaccine," the "Mad Money" host said.

- "If he's right [that] this is the beginning of a new cycle ... then this move, as implausible as it may be, could just be getting started," he said.

CNBC's Jim Cramer on Tuesday presented three potential buying opportunities connected to the chipmaking industry.

After reviewing chart analysis from a trusted technician, the "Mad Money" host is recommending investors keep an eye on two semiconductor equipment makers in particular.

"The charts, as interpreted by Bob Lang, suggest that the semiconductor capital equipment names could give you a lot more upside, even though they already have, especially Lam and Applied Materials," the "Mad Money" host said.

Lam Research, KLA Corp and Applied Materials have all surged higher in recent weeks, boosted by strong quarterly reports and demand for products. Wall Street is betting that chipmakers will spend heavily on production capacity next year and that their exposure to China will serve well under a Biden administration, after a tense trade war between the world's largest economies, Cramer said.

The question is if the stocks will be able to maintain the momentum. Lang, a technician who founded ExplosiveOptions.net and contributes to TheStreet.com, sees scenarios where it is likely.

"This is one of those bull markets that works, regardless of how long it takes for us to roll out a Covid vaccine," Cramer said. "If he's right [that] this is the beginning of a new cycle ... then this move, as implausible as it may be, could just be getting started."

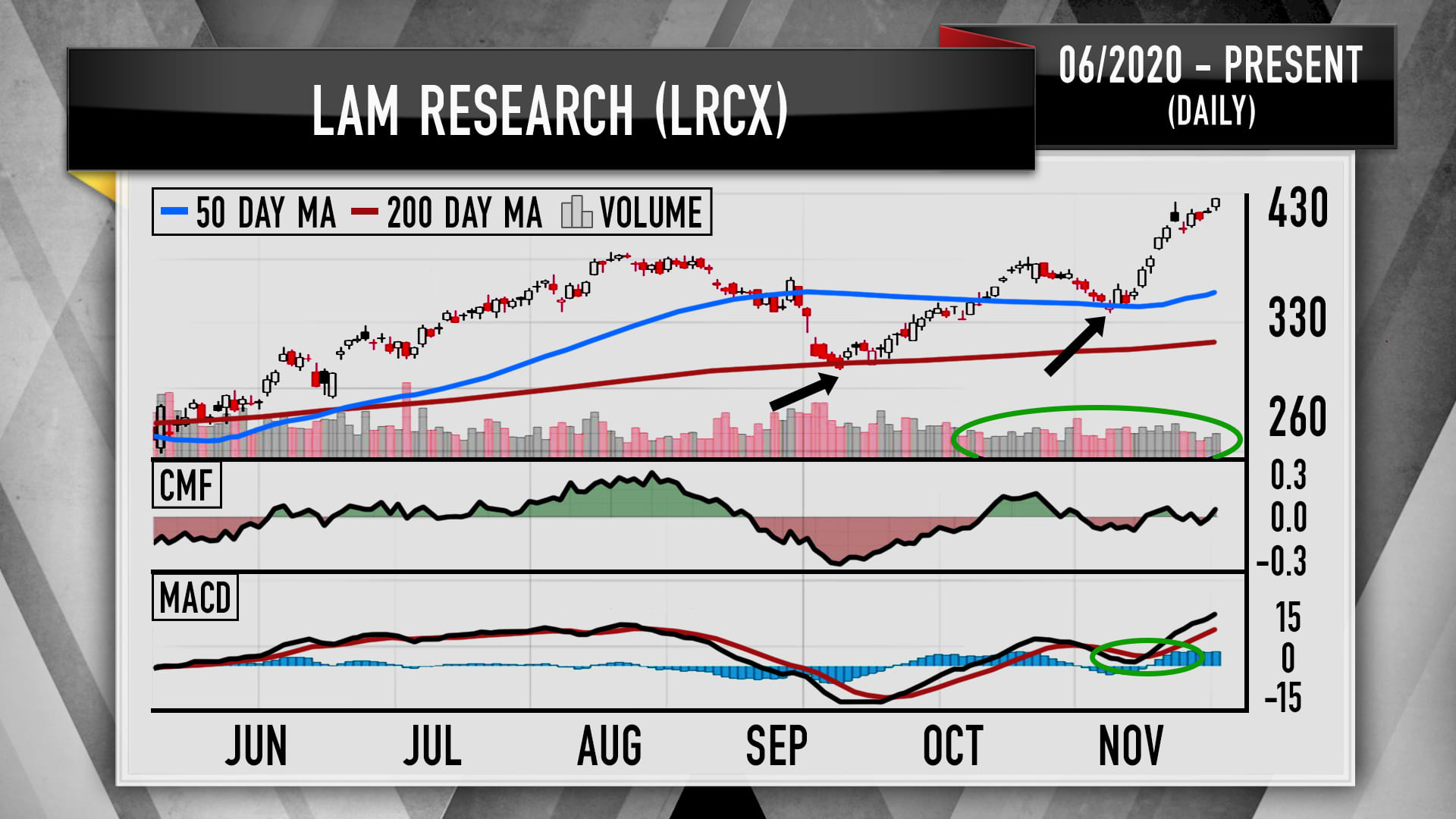

Lam has grown 18% in the past month. Lang, Cramer said, highlighted that the stock has traded in a bullish pattern, producing higher highs and lower lows on high volume. Since falling in late October to its 50-day moving average, a key trading indicator used by analysts, the stock has surged nearly 100 points, a positive sign for Cramer.

Money Report

Lang sees the stock going through an ephemeral pullback, potentially down to 400, about 7% from its current levels.

"After that pit stop, he's thinking it's smooth sailing to $500. That is some serious upside," Cramer said. "If he's right, you have to be prepared to buy the dip, and I think that business is going to be very good."

As for Applied Materials and KLA, their stocks are up 18% and 16%, respectively, in the past month. Applied Materials has been trading higher on strong volume, a sign of conviction, and broke through its August highs, creating a new floor of support, Cramer noted.

"As Lang sees it, this is a $74 stock that could be headed to $100 a share," he said.

Disclaimer

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter

Jim Cramer TwitterFacebook Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com