- Rocket builder ABL Space closed a $170 million round of funding with a $1.3 billion valuation, making it the latest private space venture to reach unicorn status.

- ABL raised the funds from T. Rowe Price, Fidelity Management, a third unnamed investment firm and existing investors.

- "If you compare us to other companies spending hundreds of millions of dollars developing launch vehicles, you should see how fundamentally differentiated our underlying approach must be to achieve that," ABL CEO Harry O'Hanley told CNBC.

Rocket builder ABL Space said Thursday it closed a $170 million round of funding, making it the latest private space venture to reach unicorn status.

ABL raised the funds from T. Rowe Price, Fidelity Management, a third unnamed investment firm and existing investors at a valuation of $1.3 billion.

"We have always prided ourselves on capital efficiency," ABL CEO Harry O'Hanley told CNBC, noting the company has spent "well under" $50 million to date.

We're making it easier for you to find stories that matter with our new newsletter — The 4Front. Sign up here and get news that is important for you to your inbox.

"If you compare us to other companies spending hundreds of millions of dollars developing launch vehicles, you should see how fundamentally differentiated our underlying approach must be to achieve that," O'Hanley added.

The company previously raised $49 million in venture capital to date, with investors including Venrock, New Science Ventures, Lynett Capital and Lockheed Martin Ventures. ABL had also announced nearly $45 million in contracts from the Air Force Research Laboratory and Afwerx. The company said Thursday it has contracts from 10 commercial and government customers.

"We think the global space economy has significant long-term growth potential," T. Rowe Price Global Industrials Fund manager Jason Adams said in a statement. "We think ABL has a management team, technology set and product strategy that should enable long-term competitive advantages."

ABL's RS1 rocket is 88 feet tall and is designed to launch as much as 1,350 kg (nearly 1½ tons) of payload to low Earth orbit. The price of each launch is $12 million. That puts RS1 in the middle of the commercial launch market, between Rocket Lab's smaller Electron for $7 million and SpaceX's heavy Falcon 9 for $62 million.

Money Report

It also pits ABL against several other companies developing "medium-lift" rockets. Richard Branson's Virgin Orbit recently reached orbit, while ABL is alongside Relativity Space and Firefly Aerospace in aiming for their first launches this year.

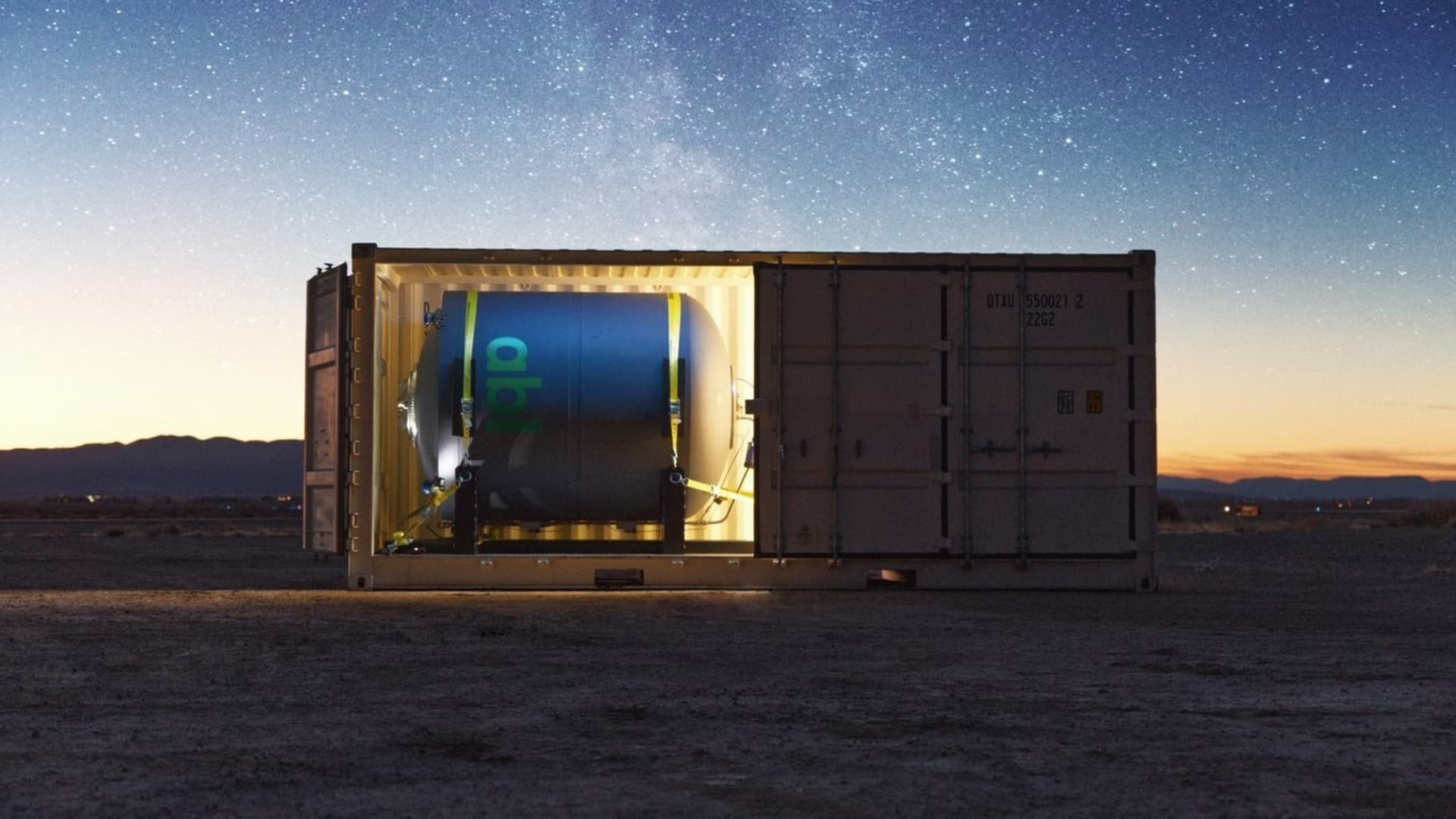

In addition to the economical approach of ABL's rocket development process, the company also touted the efficiency of its GS0 deployable ground system. It's essentially the barebones of a launch facility — the erector, fueling, electrical, control center and more — packed into a few standard-sized shipping containers.

O'Hanley said in January that ABL's rocket program was already fully funded through its first mission. On Thursday, he said the additional $170 million in capital "will give us the opportunity to set up for scaling up launch cadence to meet all the demand we are seeing in 2022 and beyond."

"It will also let us carefully start exploring more opportunities both in space tech and other domains," O'Hanley said.

ABL's new valuation also makes it the latest space venture to pass the unicorn mark above $1 billion. The company is now among the most valuable in the growing space industry, which is led by SpaceX with a $74 billion valuation and followed by a variety of companies that have announced SPAC deals in the past six months.

"We don't see our valuation as an achievement so much as a serious responsibility to deliver value," ABL President and CFO Dan Piemont told CNBC. "We've never optimized for valuation and we've kept most of our achievements private. We know we still have a lot to prove. We're out to build an enduring company with the best people, customers, and investors in the world."

"Hopefully this round shows that there's something special happening under the hood here at ABL. If you want to learn more about what that is, get in touch," Piemont added.