- Declining visits to Peloton's website and higher-than-normal promotional activity is prompting a JPMorgan analyst to lower his forecast.

- The move comes about one month before Peloton's next scheduled financial report.

- Shares of the fitness streamer touched a 52-week low on Wednesday of $32.02.

Peloton's troubles have lingered into the new year.

JPMorgan analyst Doug Anmuth said Wednesday that declining visits to Peloton's website and higher-than-normal promotional activity prompted him to lower his forecast for the fitness streamer.

Anmuth slashed estimates for revenue and subscriber growth in the fiscal second quarter, which ended in December. He expects second-quarter sales will inch up to $1.1 billion from $1.06 billion during the year-earlier period. Previously, he saw sales touching $1.2 billion.

We're making it easier for you to find stories that matter with our new newsletter — The 4Front. Sign up here and get news that is important for you to your inbox.

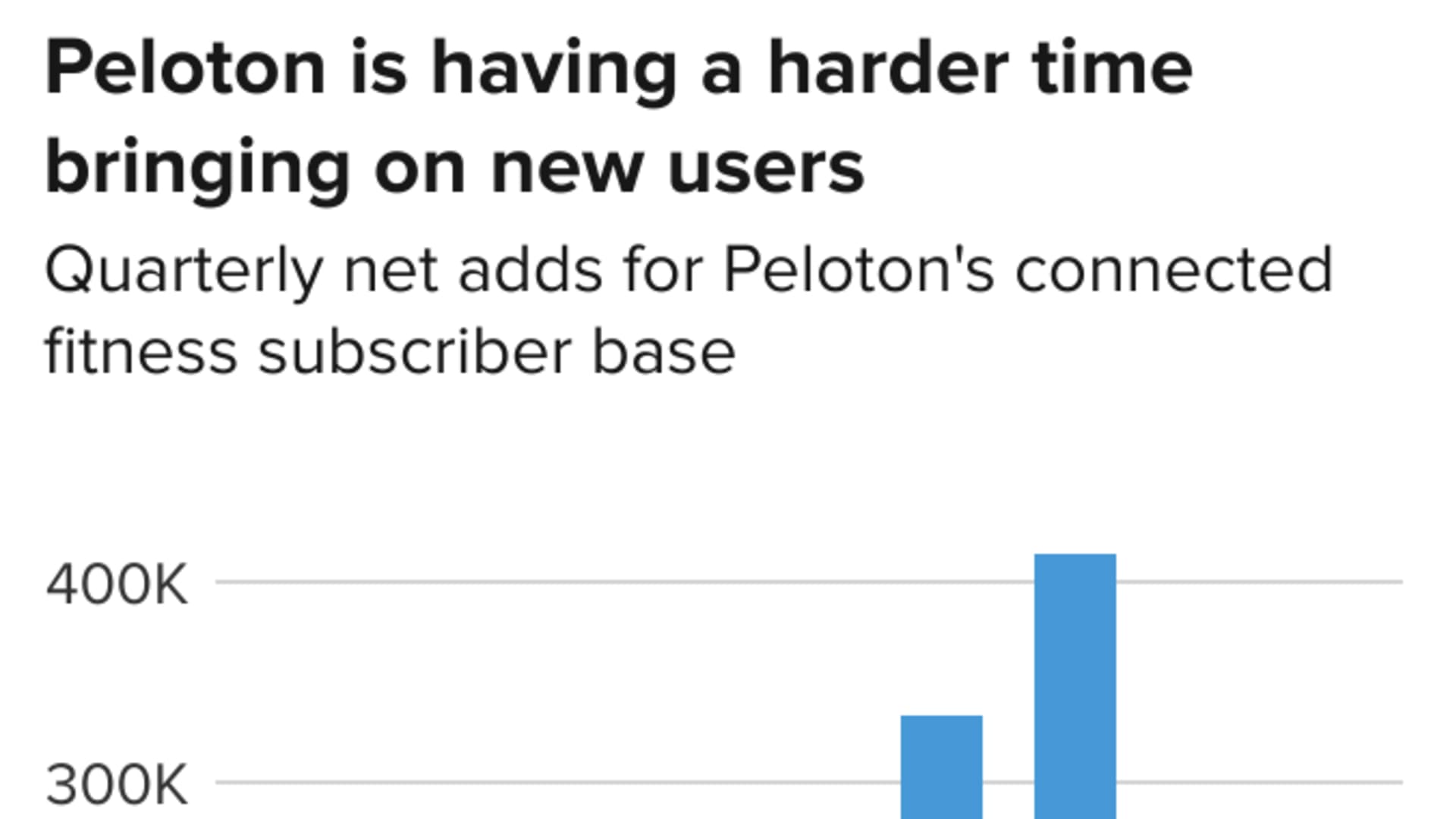

Slowing subscriber acquisitions are weighing on sales growth, and Anmuth expects Peloton to report 2.79 million subscribers, down from an earlier forecast of 2.83 million.

Both estimates are below Peloton's internal expectations. The company sees between $1.1 billion and $1.2 billion in sales, and between 2.8 million and 2.85 million subscribers.

For the full year, Anmuth forecasts sales of $4.2 billion, down from his prior call of $4.6 billion, and year-over-year subscriber base growth of 42% year, down from 47%.

If realized, that would be a marked deceleration from prior years. In 2021, Peloton's subscriber base jumped by 114% and was up 113% the previous year.

In early November, Peloton lowered its 2022 revenue expectations to between $4.4 billion and $4.8 billion, down from $5.4 billion. It also cut expectations for subscribers to a range of 3.35 million to 3.45 million, down from 3.63 million.

Money Report

Peloton likely faces soft consumer demand in the near term and uncertainty in the back half of the year, Anmuth said. Citing Similarweb data, he said visits to Peloton.com on desktop computers and mobile devices dropped 5% in the quarter ended in December compared to the year-earlier period.

Peloton declined to comment. It is scheduled to report earnings in early February.

Analysts losing confidence

Growth isn't coming as easy for Peloton as it did at the onset of the pandemic, when the company's stock was seen as a strong stay-at-home play. Now, competition is coming from other at-home fitness options and gym chains such as Planet Fitness and New York City-based Equinox. That has forced Peloton to spend more to acquire new customers.

Peloton next challenge, analysts say, is to introduce new workout devices beyond its bikes and treadmills, as well as entice existing subscribers to build out their home gyms. It's also eyeing international expansion, but that comes with short-term costs.

Anmuth cut his December 2022 price target for Peloton shares to $50 from $70. That's still about 48% upside from Tuesday's closing price of $33.82. On Wednesday, shares touched a 52-week low of $32.02 and closed the day down 4.7% at $32.23.

Analysts who cover the company expect the stock to bounce back. The stock's average price target is $72.42, according to FactSet. BMO Capital Markets analyst Simeon Siegel has the lowest target of the group, at $45.

At this point, Peloton has nearly wiped out its pandemic-fueled stock gains. In 2021, shares tumbled 76%, after rising more than 440% in 2020.

Early last week, Raymond James analyst Aaron Kessler also said he expected a disappointing December, which could prompt the company to cut its full-year forecast again.

"When Peloton provided guidance, we believe the company was assuming a return to stronger seasonality in the December quarter following the slower summer seasonality," said Kessler in a note to clients.

Net subscriber additions in the second quarter could come in closer to 220,000 compared to the first quarter, he said. Raymond James has a "bear case" rating on the stock of $27 and a "bull case" rating of $51. Kessler said a fair value would be about $38 per share.

Two days later, Baird analyst Jonathan Komp cut his price target to $70 from $90. The firm also removed Peloton from its "fresh pick" list.

"Several indicators have reduced our confidence in near-term estimates," said Komp in a research note. However, he said that he's more optimistic about Peloton's longer-term prospects in the booming health and fitness industry.

Similar to JPMorgan's Anmuth, Komp said net subscriber additions in the second quarter could be around 300,000 and miss the company's provided expectations.

He also said Peloton's instructors have not been gaining as many followers on social media platforms lately, a measure that has been a strong indicator of past performances, he said.