- Experts say that if student loan forgiveness is going to happen, it will likely be before the midterm elections.

- New servicers and additional bankruptcy protections – here's what else could be in store for the millions of Americans with education debt.

Life without student loans is coming to an end.

The U.S. Department of Education by February will restart payments for the millions of Americans with education debt. They've been allowed to pause their bills for close to two years because of the coronavirus pandemic.

Yet the resumption of the bills may be just one of many changes in store for borrowers.

We're making it easier for you to find stories that matter with our new newsletter — The 4Front. Sign up here and get news that is important for you to your inbox.

These are some of the other big possible developments on the horizon, experts say.

Loan cancellation

Although Democrats haven't included student loan forgiveness in their massive spending bill currently working its way through Congress, there's still the possibility that the relief could come from separate legislation or through executive action by President Joe Biden.

Money Report

Biden has said that he's in support of canceling $10,000 of the loans for all, but some Democrats continue to pressure him to raise that amount to $50,000.

More from Personal Finance:

How to get a jump-start on the upcoming tax season

More than 1 in 3 U.S. adults carry medical debt, survey finds

Avoid these 3 holiday scams on Black Friday and Cyber Monday

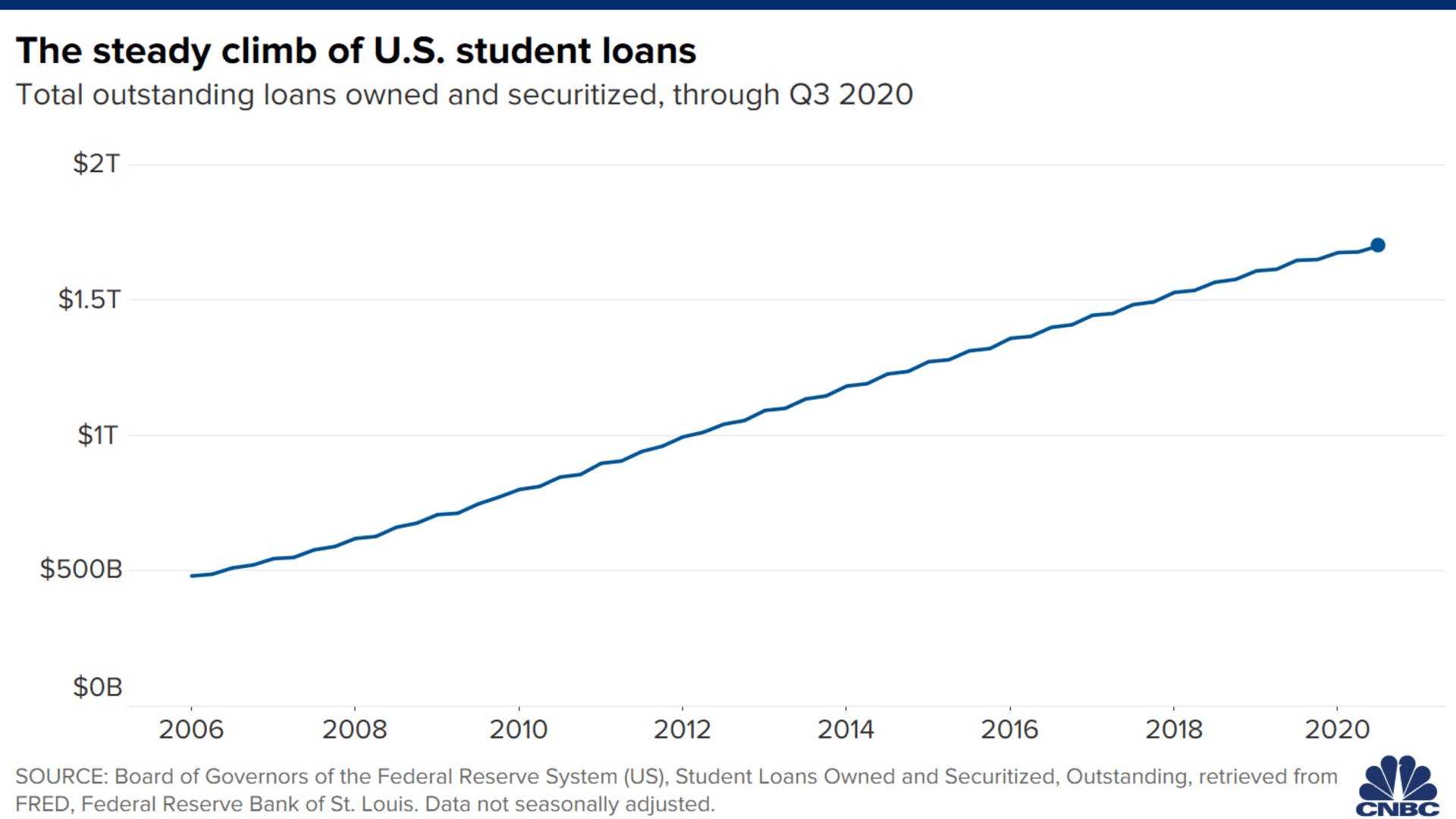

If all federal student loan borrowers got $10,000 of their debt forgiven, the outstanding education debt in the country would fall to around $1.3 trillion, from $1.7 trillion, according to higher education expert Mark Kantrowitz. And 33% of federal student loan borrowers, or 14.4 million people, would see their balances reset to zero.

Canceling $50,000 for all borrowers, on the other hand, would shrink the country's outstanding student loan debt balance to $700 billion, from $1.7 trillion. Meanwhile, the $50,000 plan would forgive all of the debt for 80% of federal student loan borrowers, or 36 million people.

After years of speculation around loan forgiveness, borrowers may soon get an answer.

"If broad student loan forgiveness will occur, it should be soon, as Democrats will want to see it implemented before the mid-term elections," Kantrowitz said.

Added bankruptcy options

The Fresh Start Through Bankruptcy Act proposed by Congress this year would allow federal student loan borrowers to discharge their debt in bankruptcy after a decade. The legislation has bipartisan support.

Walking away from your student loans in bankruptcy is close to impossible.

New servicers

Three companies that serviced federal student loans — Navient, the Pennsylvania Higher Education Assistance Agency (also known as FedLoan) and Granite State — all recently announced that they'd be ending their relationship with the government.

As a result, around 16 million borrowers will have a different company to deal with by the time payments resume, or not long after, according to Kantrowitz.

Double-check that your servicer has your current contact information, so that you receive all the notices about the upcoming change, experts say.

Impacted borrowers should get multiple notices, said Scott Buchanan, executive director of the Student Loan Servicing Alliance, a trade group for federal student loan servicers. Come February, if you mistakenly send a payment to your old servicer, he said, the money should be forwarded to your new one.

Grace period

Although federal student loan bills will technically be due again in February, borrowers may have some more time.

The Education Department is considering giving borrowers a three-month grace period "where late payments will not be reported as delinquent to the credit bureaus and the borrowers will be automatically placed in a forbearance," Kantrowitz said.

But while interest on federal student loans has been stopped during the payment pause, it will start being charged again in February.

Help with lower payments

Borrowers who've been negatively impacted by the coronavirus pandemic may want to enroll in one of the government's income-driven repayment plans when bills resume.

Under these plans, a person's payment is capped at a portion of their income and some monthly obligations wind up being as little as $0.

Usually, borrowers have to provide documentation to prove their household earnings and size; however, the Education Department is considering allowing them to temporarily self-certify this information.

Second chance for defaulted borrowers

There's some chatter that the Education Department may automatically move more than 7 million student loan borrowers out of their defaulted state, Kantrowitz said.

The U.S. government has extraordinary collection powers on federal debts and it can seize borrowers' tax refunds, wages and Social Security checks.

Most recently, advocates have warned that borrowers who've fallen behind may also miss out on the expanded child tax credit, which can be at least partially paid out as a tax refund.

Removed from default, these borrowers would be shielded from these tactics.