Many of the indicators of stock market euphoria are flashing bright red signals as the market barrels ahead to uncharted new heights.

There are many tools in the financial toolbox to evaluate stock market euphoria, and here is one that is as frightening as any.

The chart below measures margin debt as a percentage of GDP.

We're making it easier for you to find stories that matter with our new newsletter — The 4Front. Sign up here and get news that is important for you to your inbox.

As of December 30, 2020, margin debt in the U.S. was a staggering $778 billion, 34% higher than the $679 million amount a year earlier.

Measured as a percentage, margin debt is now 3.6% of GDP, a figure that can be added to the list of frightening statistics of current market exuberance.

Note that we have now surpassed the peaks of 2000 and 2008 in terms of margin debt as a percentage of GDP. Both of those periods were followed by major stock market declines.

Money Report

Given today's comparable state of euphoria, it seems strange that the Federal Reserve is not using one of its tools that might dampen the excessive market speculation.

The Fed has the power to regulate brokers' margin rates under Regulation T, but it hasn't used that power since 1974 when the margin rate to borrow on stock purchases was set at 50%.

With a 50% margin rate, investors can borrow up to 50% of the amount of their qualified stock purchases. That means that an investor who wants to buy $10,000 worth of stock can buy $20,000 worth by just putting up $10,000 and borrowing the rest.

It is easy to see how this kind of buying power can add momentum to a speculative bull market.

Back in 1929, brokers lent speculators as much as 90% of the value of their stock purchases, adding fuel to the fire of soaring stock prices.

As we all know, this was followed by the Crash of 1929, and the beginning of the Great Depression.

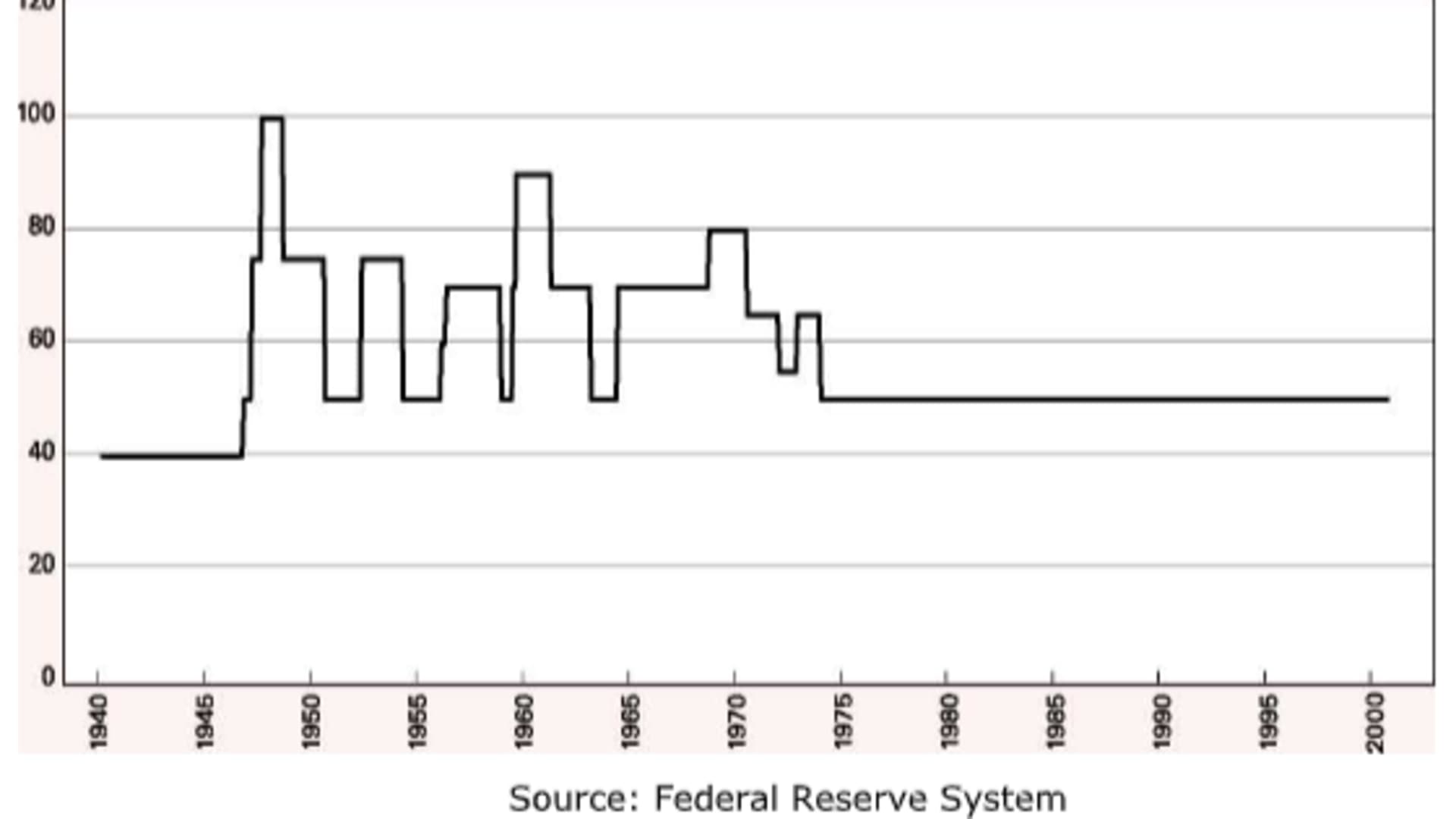

As can be seen from the chart below, prior to 1974, the Fed paid a great deal of attention to margin rates and changed the rate many times as it viewed market conditions and other factors at the time.

Regulation T initial margin requirement

Yet, as we pointed out, the Fed stopped using this tool in 1974. Maybe now would be a good time to revisit this policy.

—Peter J. Tanous is chairman of Lynx Investment Advisory in Washington, D.C.

For more insight from CNBC contributors, follow @CNBCopinion on Twitter.