- China said it applied to join CPTPP, an 11-nation trade pact formed in 2018 after the U.S. withdrew from the Trans-Pacific Partnership a year earlier.

- Beijing needs the approval from all 11 CPTPP signatories to join CPTPP, and it may not succeed given its strained relationships with some member countries, said analysts.

- Beijing may also have difficulties fulfilling the mega trade pact's demands for a level playing field in areas such as state-owned enterprises, labor rights and cross-border data flows, said analysts.

- Nevertheless, China's application to join CPTPP stands in contrast to the U.S.' lack of economic policy in Asia-Pacific, analysts said.

China will likely fail in its bid to join the Comprehensive and Progressive Trans-Pacific Partnership — but its move to submit an application highlighted the lack of U.S. economic policy in Asia-Pacific, said analysts.

CPTPP is an 11-nation mega trade pact formed in 2018 after Donald Trump pulled the U.S. out of the Trans-Pacific Partnership a year earlier.

President Barack Obama had negotiated the TPP to deepen U.S. economic engagement in Asia-Pacific and counter China's growing influence in the region.

We're making it easier for you to find stories that matter with our new newsletter — The 4Front. Sign up here and get news that is important for you to your inbox.

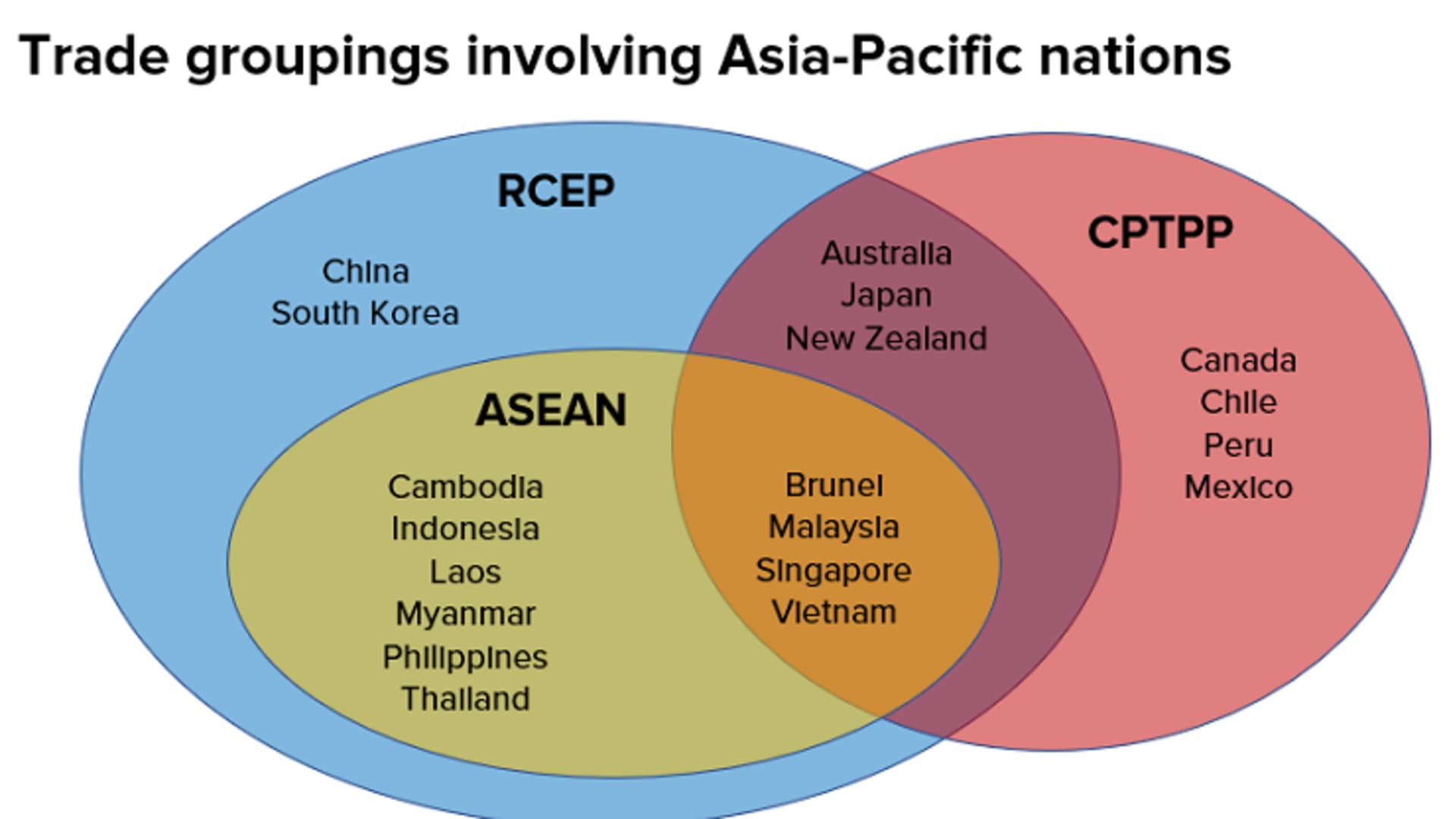

All 11 signatories of the CPTPP must agree to China's request to join before it can be admitted as a member. The countries in the CPTPP are: Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam.

Beijing's strained diplomatic relations with some member countries would hurt its chances, said analysts. China will also likely face difficulties in meeting the trade pact's demands for a level-playing field in many aspects of the economy, they added.

Money Report

China is not the only one that's applied to join the CPTPP; the U.K. and Taiwan have done the same.

U.S. allies in CPTPP

U.S. allies in the CPTPP such as Australia, Canada and Japan increasingly view China as a "strategic threat," and they could block China's application, said analysts from risk consultancy Eurasia Group.

"Beijing would need to make major concessions on many issues to rebuild goodwill with them. Absent a momentous shift in Chinese policy, the consent of these three countries is doubtful," said the analysts.

One of the contenders in the race for Japan's next prime minister has reportedly questioned China's ability to meet CPTPP standards. Australian Trade Minister Dan Tehan also stressed in a Wednesday speech that any country that wishes to join the trade pact "will have to abide by all the rules and the standards."

Japan has an existing territorial dispute with China in the East China Sea, while Australia has been at the receiving end of import tariffs imposed by China.

Meanwhile, Canada and Mexico could stand in China's way through the United States-Mexico-Canada Agreement or USMCA. The trade deal contains a "poison pill" provision requiring any of the three members to consult the others if it wishes to pursue a trade deal with a "non-market country."

Many analysts said the clause could have been aimed at China. USMCA was negotiated by the Trump administration and replaces the North American Free Trade Agreement or NAFTA.

Meeting CPTPP standards

In addition to political hurdles, China may have difficulties meeting CPTPP provisions that promote cross-border data flows, labor and environmental protection, as well as restrictions on state-owned companies, said analysts.

Businesses from the U.S. and the European Union are among those that have complained about China's unfair trade practices, such as subsidizing state firms, the lack of intellectual property protection and forced technology transfer.

"Its entry into the trade pact would require China to agree to rules on state firms and labour and environmental regulations that would be a major departure from its current stance," economists from consultancy Capital Economics wrote in a report.

"It's hard to see how the push for self-sufficiency can be squared with the CPTPP's demands for a level playing field," they added.

Other trade experts said it won't be that difficult for China to meet requirements in the mega trade pact.

That's because CPTPP is less ambitious than its predecessor TPP and has "ample exceptions and wide loopholes" that would help China comply with the more challenging provisions, said Stephen Olson, senior research fellow at Hinrich Foundation, a nonprofit focused on trade issues.

"And in those cases where the stipulated exceptions are insufficient, China has already demonstrated its immense skill in bending, evading, and otherwise nullifying trade rules in other agreements," said Olsen.

'Smart diplomacy'

Regardless of its success, analysts said China's CPTPP bid highlighted the country's expanding economic clout in Asia-Pacific, while the U.S. has largely focused on security issues in the region.

That's especially so when China's application followed the formation of a new security partnership among Australia, the U.K. and the U.S. — referred to as AUKUS, analysts said.

"This move is smart diplomacy following the announcement of the AUKUS security partnership because it turns diplomatic attention to trade and investment issues in the Asia-Pacific, where the US has made little progress in countering China's economic heft," said Eurasia Group analysts.

Beijing criticized AUKUS, but denied its CPTPP application was related to the security partnership.

President Joe Biden has made it a priority to bolster U.S. standing in Asia-Pacific. But his administration has not articulated a trade policy on China, and experts have said the U.S. is unlikely to join CPTPP due to domestic politics.

Meanwhile, China has become a major trading partner for many countries in the region, and last year led 14 other regional economies to sign the world's largest trade agreement — the Regional Comprehensive Economic Partnership or RCEP.

"Unfortunately, the one thing that is clear is that the United States is once again reacting rather than leading and therefore letting China determine the course of events in Asia," said William Reinsch, senior advisor and Scholl Chair in international business at Washington D.C.-based think tank Center for Strategic and International Studies.