Bank stocks are breaking out in a big way.

The SPDR S&P Bank ETF (KBE) hit the highest levels it's seen since 2007 in Thursday's trading, fueled by the yield on the U.S. 10-year Treasury note rising to 14-month highs. The moves came despite the Federal Reserve's Wednesday statement that it would keep interest rates near zero through at least 2023.

Two traders told CNBC on Thursday that while bank stocks are attractive over the long term, it's worth waiting for a pullback to buy in.

We're making it easier for you to find stories that matter with our new newsletter — The 4Front. Sign up here and get news that is important for you to your inbox.

"Even though I am very bullish on a long-term basis on the bank stocks ... they are getting quite overbought and so is the yield on the 10-year note," Matt Maley, chief market strategist at Miller Tabak, said on CNBC's "Trading Nation."

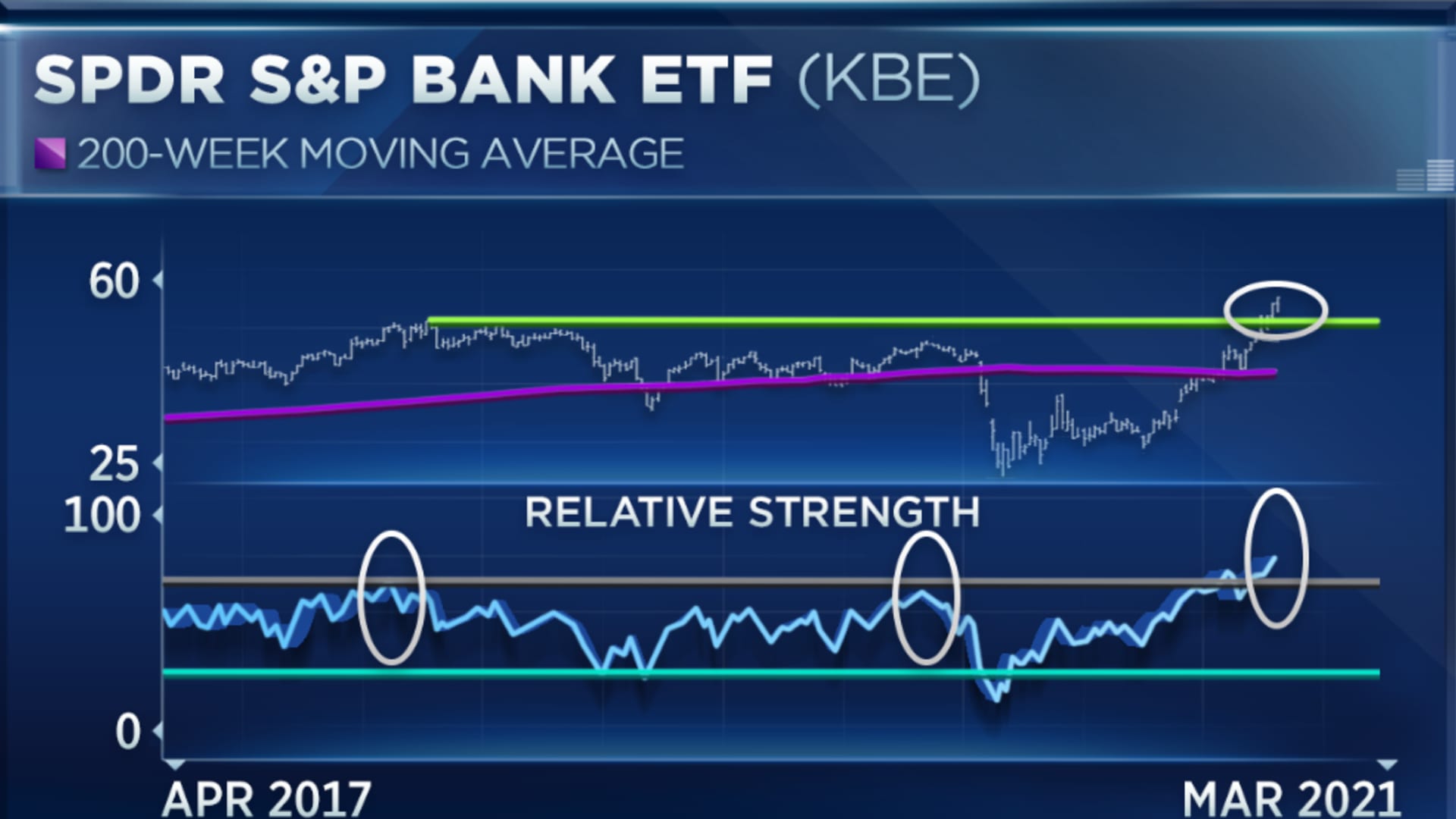

The KBE's relative strength index — a momentum indicator frequented by chart analysts — is the most overbought it's been in three years, which means "it's getting ripe for a bit of a pullback," Maley said.

To make things more dire for investors, the 10-year yield is the most overbought it has been since 1994, the strategist warned.

"I currently believe that the Fed, even though they're talking about doubling down on being dovish on short-term rates, they're actually more hawkish on long-term rates because they're willing to let inflation run higher," Maley said.

"That means … rates will go higher over time, but the short-term technical picture is telling me they should pull back a little bit," he said. "So, I wouldn't jump back into these bank stocks at these levels. I'd let them come back in and add to positions after that takes place."

Money Report

When that pullback comes, three stocks will be particularly good opportunities, Nancy Tengler, Laffer Tengler Investments' chief investment officer, said in the same "Trading Nation" interview.

"We went overweight [banks] in the … late summer and we really emphasized companies that had exposure to interest rates, but also had diversification in terms of noninterest income," Tengler said.

Her firm's largest holdings in the space are JPMorgan, PNC Financial and Goldman Sachs, which is also part of Laffer Tengler's "12 best ideas" portfolio.

"Though I agree with Matt — the stocks have run hard, so, you don't need to jump in with both feet — on a fundamental basis, these companies are looking better and better as time goes on," Tengler said.

"I think the Fed may be letting the bond market do its work for it in steepening the yield curve," she said. "They keep short rates very short and are willing to let the yield curve steepen. And so, while we think the stocks are somewhat expensive on valuation, they're still attractive in our work and we're going to continue to pick away at them on weakness."

Disclosure: Laffer Tengler Investments owns shares of JPMorgan, PNC Financial and Goldman Sachs.